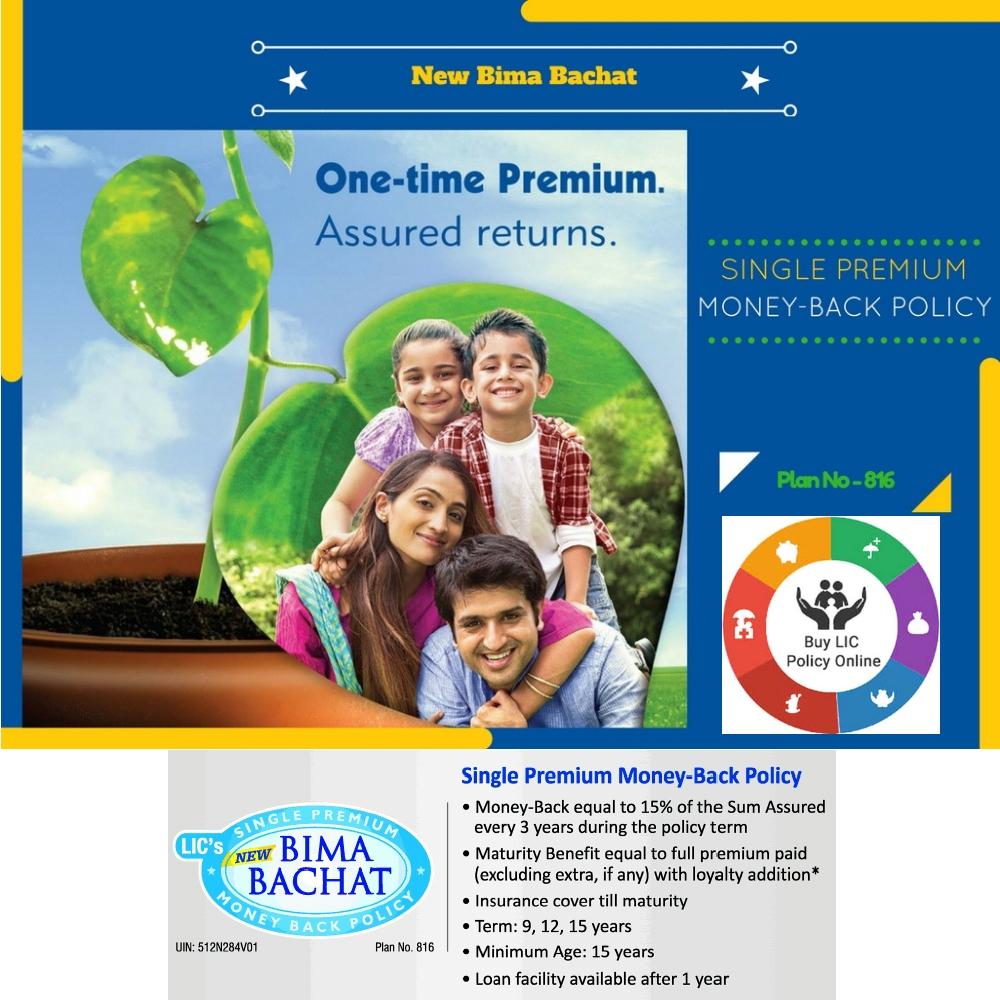

This is a single premium, non-linked, with profits Money Back type Plan.

DEATH BENEFIT:

During 1st five years policy years : Sum Assured only.

After completion of five policy years : Sum Assured + Loyalty Addition, if any.

SURVIVAL BENEFIT:

For Policy Term of 9 years :15% of SA, after 3rd & 6th policy year.

For Policy Term of 12 years :15% of SA, after 3rd ,6th & 9th policy year.

For Policy Term of 15 years :15% of SA, after 3rd ,6th,9th & 12th policy year.

MATURITY BENEFIT:

Single Premium Paid + Loyalty Additions, if any.

Example*:

Age- 35, S.A.- `1,00,000, Term – 12 years, Single Premium-`74,434

Entry Age: 35

SB at the age 38 : 15% of S.A=Rs.15,000

In case of death at the age 40:

Death Benefit = Sum Assured + Loyalty Addition (if any)

= Rs.1,00,000+Loyalty addition for 5years.

SB at the age 41 : 15% of S.A=Rs.15,000

SB at the age 44 : 15% of S.A=Rs.15,000

Maturity at the age 47:

Maturity Benefit = Refund of Premium + Loyalty addition if any

=Rs.74,434 + Loyalty addition for 12years

Features & Conditions:

Minimum age at entry : 15 years lbd

Policy term : 9, 12 or 15 yrs

Term Max Age atEntry Min SumAssured

9 years 66 years ` 35,000

12 years 63 years ` 50,000

15 years 60 years ` 70,000

Max. Age at maturity : 75 years nbd

Maximum S.A. : No limit

SA in multiples of `5,000 only.

Available Riders: Nil

Mode of Payment: Single Premium

Policy Loan: Only after one policy year.

Back Dating: Allowed without lean months benefit. Interest will be charged for exact no. of days from DOC to date of payment.

Service Tax: 3.75%

Tax Benefits :

On Basic Prem : u/s 80C up to 10% of SA

Maturity : Taxable

Death Claim : u/s 10(10D)

Leave a Reply